In the ever-evolving landscape of personal finance, selecting the best credit cards has become more than just a transactional choice; it’s a strategic decision that can significantly impact your financial journey. With a myriad of options available, each flaunting its unique perks and benefits, navigating this world demands careful consideration and a discerning eye.

The Quest for Excellence

1. Tailored Rewards and Perks

When it comes to the realm of credit cards, one size does not fit all. The best credit cards offer rewards and perks that align with your lifestyle and financial goals. From travel enthusiasts to cashback connoisseurs, there’s a credit card that caters to your specific preferences.

2. Elevated Credit Limits

Premium credit cards often come with higher credit limits, allowing you greater financial flexibility. This can be particularly advantageous for managing larger expenses or unexpected emergencies.

3. Concierge Services

Step into the realm of exclusivity with concierge services that cater to your needs, from booking reservations at renowned restaurants to securing coveted event tickets.

Exploring the Elite: Types of Premium Credit Cards

1. Travel Rewards Cards

For the globetrotters and jet-setters, travel rewards cards offer a gateway to exclusive travel benefits, including airline miles, hotel upgrades, and airport lounge access.

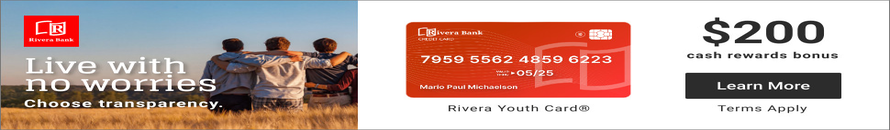

2. Cashback Cards

Unleash the power of spending with cashback cards that offer a percentage of your purchases back to you, providing tangible rewards for your everyday transactions.

3. Premium Rewards Cards

Experience the epitome of luxury with premium rewards cards that offer a blend of travel perks, exclusive experiences, and elevated rewards.

Decoding the Selection Process

1. Assessing Your Lifestyle

Before embarking on the journey to discover the best credit cards, reflect on your lifestyle, spending habits, and financial goals. A card that resonates with your preferences will offer the most value.

2. Weighing Annual Fees

While premium credit cards often come with annual fees, the benefits they offer can easily outweigh these costs. Carefully evaluate the rewards and perks to ensure they align with your financial aspirations.

3. Bonus Offers

Many credit cards come with enticing sign-up bonuses, which can include a substantial number of rewards points or cashback for meeting specific spending requirements.

Embrace the Possibilities

The realm of premium credit cards invites you to embrace the possibilities of a financial landscape enriched with privileges, rewards, and opportunities. As you embark on this journey, consider the symbiotic relationship between your lifestyle and the card’s offerings. The best credit cards are not just tools for transactions; they are instruments of empowerment that elevate your financial journey.

In a world where choices are abundant and financial aspirations are diverse, the quest for the best credit cards is a narrative of empowerment. It’s a tale of aligning your values, goals, and dreams with a financial companion that goes beyond transactions to create experiences. As you venture forth, remember that the best credit card for you isn’t just a card; it’s a passport to a world of possibilities.

More Stories

0% APR Credit Card Great Reviews: Interest-Free !